Facing and Mastering Digital Transformation

The shock of the new still makes some organizations shy away from facing the challenges of digitalization. Roland Broch from the eco Association looks at how the German Mittelstand and SMEs in general can embrace the potential of digital transformation to compete in the digital economy of the future.

© NicoElNino | istockphoto.com

Germany is the land of the so-called “Mittelstand” and “hidden champions” – medium-sized companies that quietly achieve great things. It is a country that has a tradition of being relatively slow to adapt to change, but which works hard in perfecting products and processes over time. It tends not to be a country where a quick buck can be made, nor where start-ups have an initial “walk in the park”.

Failing fast and bouncing back is not a concept that comes easily to the German business mentality. Succeeding slowly is more the style.

The problem is that digital transformation, wherever it occurs, requires a quick response, rapid adaptation, and a willingness to take risks – perhaps fail, but then get back up and try again. It is important for small and medium-sized companies in Europe, and especially in Germany, to start catching up, to embrace the opportunities of digitalization, and not to be left behind in international competition.

How German companies see digitalization

The German Federal Ministry of Economic Affairs and Energy (BMWi) Monitoring Report (p. 7) for 2018 presents figures for the level of digitalization of German companies.

I’m just going to look at three figures here. Firstly, the proportion of companies that see digitalization as important or very important (46%) has grown by 10% in the past year. And moving on, the proportion of companies that actually generate business through digital products in Germany in 2018 stands at 37%. These are companies generating more than 60% of their turnover from digital services. So far, so good.

But in certain areas, the traditional reticence to seize new opportunities is seen to rear its head. For example, when we look at the number of German companies that actually exploit digital services for professional benefit, the figure has dropped from 31% to 26% in the year gone by. So while there may be a professed interest in digitalization growing in Germany, only a quarter of companies are actually using digital services to support their business.

The German Mittelstand – and in fact, SMEs everywhere – are feeling the justifiable pressure to change in response to digitalization. They need to take stock at this point, and ask themselves what direction they want to take. We have a situation today that the middle is starting to shrink in markets around the globe. Digital transformation is leading to a choice between two directions for company evolution – either the mass market or the highly customized niche market.

As long as the German “Mittelstand” can navigate this transformation, their prospects are good. As hidden champions, many are well-placed to exploit niche and luxury markets. Those that are big enough have the opportunity to grow further through mergers and acquisitions, so that they are in a position to sell to the mass market.

Understanding digital transformation – learning to cope with change

Digital transformation: Whether you’ve been consciously aware of the change or not, we’ve all seen its impact on the middle of the market. The local bank, with its friendly customer service, is closing down everywhere you look. Banks themselves need to specialize – either going into specialist brokering services for high-paying customers, or into the mass market with online banking. The typical smaller car mechanic shop is no different. It may need to choose between becoming a discount brakes and tires workshop, making use of readily available replacement parts, or specializing in classic cars of a particular vintage – for which it then becomes the national specialist and first port of call for enthusiasts.

So, yes, the Mittelstand needs to re-think its business cases in response to digital transformation.

While adapting to changing market conditions is not easy, especially for traditional German companies that prefer change to be gradual, the writing is on the wall in terms of needing to rethink the culture of slow and steady incremental development. We often read about the need to engage in change management to get buy-in from the company workforce. But it’s not only the workforce that need to face their anxieties about change – it’s also the managers, the leaders, and the strategists.

Germany and the changing digital landscape

We are not only seeing digital transformation occurring in general business cases, we also see it in the digital infrastructure industry itself. Take data centers as an example: What used to be the completely standard company-owned data center is being replaced. Companies are choosing rather to outsource, on the one hand, to large colocation data centers or large hyperscale data centers – because of their economies of scale to run the data center more economically – and on the other hand, depending on the business case, companies may choose to go to an absolute specialist with niche applications and specialist skills for specific business requirements.

According to the Borderstep Institute, Germany has the greatest quantity of data center space in the EU. Taken together, Germany, the UK, and France combined account for almost two thirds of the data center space in the EU. And forecasts strongly predict continual growth in data center space in Germany in the coming years.

While these forecasts are undoubtedly positive, there is nonetheless a growing problem with which Germany must contend: one of scale. Germany is yet to welcome its first truly hyperscale data center. As Dr. Béla Waldhauser, from the Alliance for Strengthening Digital Infrastructures in Germany, comments in his interview: “If you look at the press, then the hyperscale data centers are mostly placed in Scandinavia or Dublin, if we are talking about Europe. From a German point of view, I’m not happy that we don’t have any hyperscale data centers at the moment in Germany.” Why is this important? Because the very big data centers offer fertile ground for the growth of the digital economy as a whole.

The large data metropolises, like Frankfurt, London, Amsterdam, and Paris, allow digital ecosystems to flourish. These ecosystems consist of all sizes and models of data center, from the mini to the mega, along with content providers, carriers, Internet service providers, Internet Exchanges, and so on – and these will form an integral part of future economic development of every region. Hyperscale data centers represent an important element of these ecosystems, and there needs to be support to enable these also to develop. Without this multifaceted ecosystem of digital infrastructure, it will become more difficult for the next level of digital innovations, such as smart city, the connected car, artificial intelligence, and autonomous vehicles, to become further established.

Five years ago, the hyperscaler was hardly known. And just look at how this market is growing: in 2015 there were only about 250 hyperscalers worldwide. By 2021 it is estimated that there will be 630 of them – a growth of 250 percent. But just the number of data centers doesn’t do justice to the importance of this trend. When, instead, you look at the number of servers, then Cisco estimates that in 2015 almost 21 percent of all servers were running in hyperscale data centers, whereas by 2021 it will be more than half of all servers worldwide. This demonstrates how important it is to make conditions conducive to the building of these supertankers of the data economy.

Change management – at every level

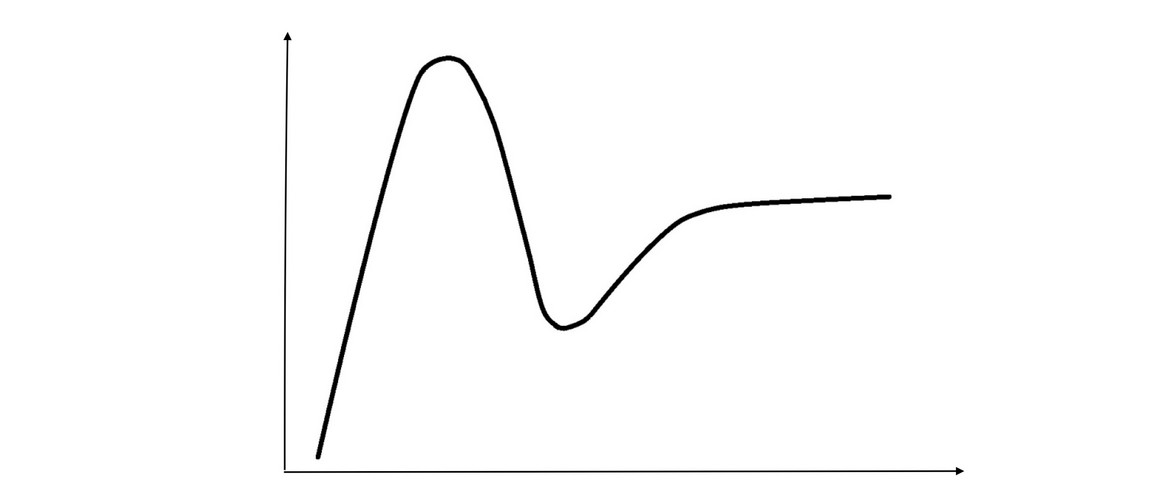

In order to create the necessary cultural shift which involves a wholehearted embracing of digital transformation, it’s worth thinking about how humans as a species react to change. We tend to react emotionally, with a highly-charged initial response, a strong negative downturn, and a slow readjustment.

The curve looks something like this:

Generalization of Human Reaction to Change (modelled on the Gartner Hype Cycle)

Now, we see this pattern repeating in different contexts when it comes to confrontation with the new. We see it in the phases of the Gartner Hype Cycle, with the “Peak of Inflated Expectations”, the “Trough of Disappointment”, and then the long road to the “Plateau of Productivity”, illustrating how media hype and trends evolve.

Or maybe you’re more familiar with the Kübler-Ross Curve, which describes the process of dealing with grief – moving from the strength of denial to the lows of depression, and then back out the other side to experimentation and integration, and into a new world view. Tellingly, this pattern also reappears in the Dunning-Kruger Effect, which illustrates how we deal with learning about a new topic, and our own self-assessment of knowledge and capacity in this new topic. Here we move rapidly from a position of complete ignorance to an exaggerated belief in our own level of knowledge, “Mt Stupid”. Then, with increased knowledge, our self-assessment plummets into the “Valley of Despair”, before slowly regaining confidence on the “Slope of Enlightenment”.

Whatever we are exposed to, it’s important for us to get beyond the emotive highs and lows, so that we can take a more rational approach to the new situation. It is a question for us as to how rapidly we can move through the curve towards the slope of enlightenment and the plateau of productivity.

Ten years ago, there was a video rental store on every street corner. Now they’re all gone, replaced by completely digitalized products, streamed to multiple devices through high-speed Internet connections. What will things look like in another ten years? There is enormous potential for companies that can exploit digitalization and remain competitive in the world market.

The Mittelstand, and small and medium-sized companies everywhere, need to get past the denial stage, and on to experimentation and integration. To make sure they are a position to compete in the digital economy of the future.

Roland Broch is Head of Member Development and the contact person for the Data Center Expert Group at eco - Association of the Internet Industry