Shopping and Paying in German e-Commerce

Online retail has moved quickly beyond desktop online shops. Lars Hofacker and Dorothee Frigge of the EHI Retail Institute spoke to dotmagazine about the systems used by online shops in Germany, the optimal mix of online payment methods, the EHI seal of trust, and the future of online retail, as they see it.

Source: EHI Retail Institute

DOTMAGAZINE: Can you start by giving us a brief overview of the range of shop systems?

LARS HOFACKER: There is a wide range of different shop systems in the ranking of the largest 1,000 online shops in Germany. Magento is one of the most commonly used systems with 14.5 percent. OXID Eshop followed with 9.3 percent of the shops and Shopware with 5.7 percent. Hybris is used by 4.4 percent of the providers. The free system osCommerce could be identified in 2.4 percent of the cases. At 48.3 percent of the online shops, the shop system could not be detected automatically. This means that they are either proprietary developments, shop systems that are not known to the analysis software used, or shop systems that have been customized so that the origin is no longer obvious.

DOT: There are so many different payment systems to choose from – How can e-shop operators and consumers alike find the best solutions for their needs?

DOROTHEE FRIGGE: There is no recipe for an optimal payment mix in an online shop. Each trader should individually analyze their industry and target group, weigh their financial resources and consider how great their willingness is to offer risk-based payment services. As for the last factor; more and more service providers have entered the market in recent years, which ensure default risks. This is usually more expensive for the merchant than processing the payments themselves, but minimizes the risk. This makes it possible to offer some of the most popular payment methods, for example, by invoice or direct debit.

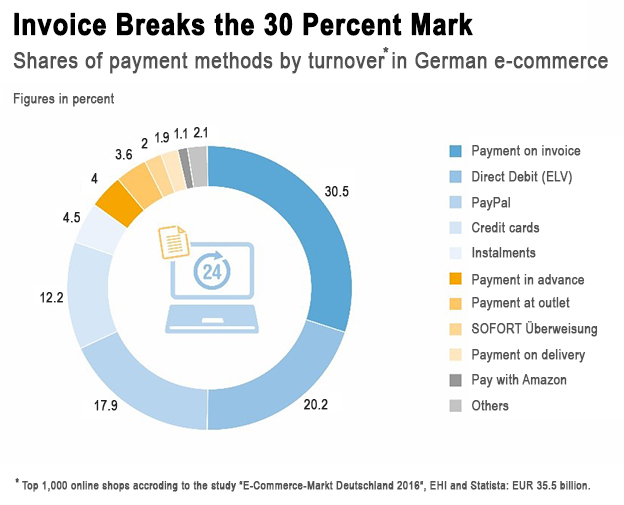

In order to address the needs of many customers, it is recommended to offer a mixture of classic, card-based, account-based, and alternative payment methods. In particular, credit card payments and Paypal should not be missing in any online shop. If, additionally, invoice and credit transfer service are offered, the dealer is very well placed. Many traders, however, offer significantly more payment methods or even offer several services of the same methods. The 1,000 leading German online shops (in terms of turnover) offer, on average, seven different payment services. In Germany, most turnover is made by invoice. The payment method which allows the customer to pay after receiving the goods, has a turnover share of more than 30 percent. Payments by direct debit (20.2 %), PayPal (17.9 %), and credit cards (12.2 %) follow. With shares of below five percent, all other payment methods are less important.

Online shops who are internationally active should precisely analyze their target market. In addition to the well-known international payment methods, in many countries there are additional national payment services, which are extremely popular with customers and should not be missing in the local payment mix. In the Netherlands, for example, only 5 percent of all payments are processed via PayPal. The national payment service iDEAL, by contrast, has a market share of 56 percent. Other major national payment services are, for example, eps (Austria), PostFinance (Switzerland), and Przelewy24 (Poland).

Both nationally and internationally dealers can also use the services of so-called payment service providers. These maintain contracts with numerous payment service providers and can thus offer traders the processing of several services from one hand. In addition, the service providers have experience with different industries, target groups and markets, and can help traders to find a suitable payment mix for their shops.

Source: EHI Retail Institute, from the Online Payment 2017 study

DOT: What are the pros and cons of omni-channel retailing vs. purely online retail, and what kinds of companies are best served with each?

HOFACKER: Each strategy and branch has its own challenges. There is no recipe for success. I think the pure online players are often faster in realizing approaches. Only the fast and well-positioned omni-channel retailers can be successful.

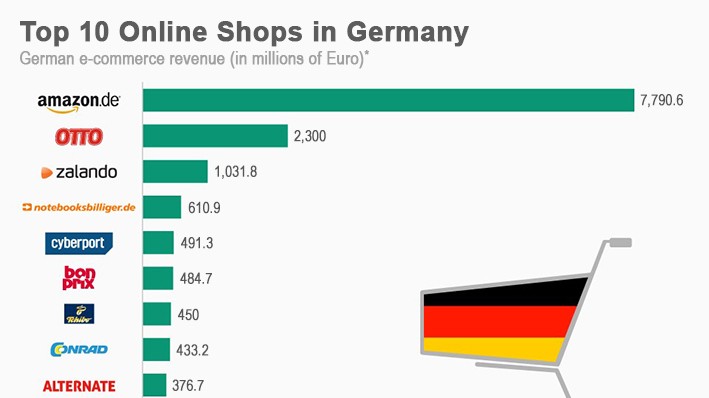

The most obvious criterion is still e-commerce revenue.

Source: EHI Retail Institute

Image: EHI Retail Institute, from the “E-Commerce-Markt Deutschland 2016” study

www.ehi.org/de/pressemitteilungen/einsames-wettrennen-an-der-e-commerce-spitze/

www.ehi.org/de/pressemitteilungen/shop-in-der-hosentasche/

DOT: EHI offers a seal of trust for online shops – what do you examine, and what is involved in preparing for an audit?

HOFACKER: Our seal of trust “EHI Geprüfter Onlineshop” is an independent department within the EHI. In order to start the certification process, an online shop needs to register with the EHI seal of trust on the website of our colleagues. They only need the domain of the shop, the contact data, and the shop’s annual turnover, as that is what the annual certification fee is based on. The shop will then be assigned a personal auditor who will guide it through the entire process.

The auditor will prepare a comprehensive report of what the EHI deems appropriate changes needed in the online shop. These changes may be required for legal reasons or to improve customer usability. The changes are color-coded to display different levels of urgency; some features are more legally troubling or more customer dissatisfactory than others. The report not only indicates what needs to be improved, but also offers solutions how to do so. Following the audit, the report will be made available to the online shop. The shop now has time to implement these changes to an extent where the auditor feels comfortable awarding the EHI seal of trust. The online shop may then display the EHI seal on their website.

The audit includes legal texts like terms of conditions, privacy protection, and returns policy, as well as the usability of check-out process and product pages. A mock order is also part of the audit. The length of the certification process depends on shop size and resources designated to the implementation of the required changes. However, an instant audit may be purchased for a fee.

DOT: What do you see as the most exciting recent innovations in online retail, and what will be the next big transformation?

HOFACKER: The omni-channel transformation is still on going. New innovations will follow with this infrastructure. I am curious about how e-commerce is spreading more and more throughout the home. With artificial intelligence applications, voice control, and automated orders are becoming increasingly standard. Previously, desktop online shops and mobile online shops were indispensable.

FRIGGE: An exciting development, which not only influences the way how we shop online, but also the way how we pay, are voice assistants. Then, when Alexa and Co. make our orders on call, the payment is increasingly invisible and disappears from the perceived shopping process. As soon as the customer has deposited his payment data once, the payment will automatically run in the background. Unlike today, where the customer is usually met with a conscious decision for or against a method of payment at each check-out, payment methods and their brands will move into the background in the future. There are also fewer opportunities for traders to direct the customer's choice of payment in their own interest.

By the way, Voice Commerce is just one example of the fact that the payment process becomes invisible. Other prominent examples include the use of Amazon Dash Buttons or riding with Uber.

EHI is a scientific institute of the retail industry in Germany. Its more than 800 members include international retail companies and their associations, manufacturers of consumer and capital goods, and various service providers.

Lars Hofacker is Head of Research E-Commerce at the EHI Retail Institute. He is the author of the annual studies E-Commerce Market Germany and E-Commerce Market Austria/Switzerland, and also organizes the annual EHI Omnichannel Days.

Dorothee Frigge is Project Leader for Online and Mobile Payments at the EHI Retail Institute. She explores strategies, challenges, and perspectives of digital and mobile payment systems in e-commerce and at the POS, carries out the annual EHI study on online payments and runs the EHI working group Online and Mobile Payments.

Please note: The opinions expressed in Industry Insights published by dotmagazine are the authors' own and do not reflect the view of the publisher, eco – Association of the Internet Industry.