Germany Data Center Market: Current Status and Future Growth

Germany’s data center market is expanding rapidly, driven by cloud adoption, 5G, and sustainability initiatives. Thomas Amberg from Ynvolve explores key trends and challenges in this evolving landscape.

©Kwarkot | istockphoto.com

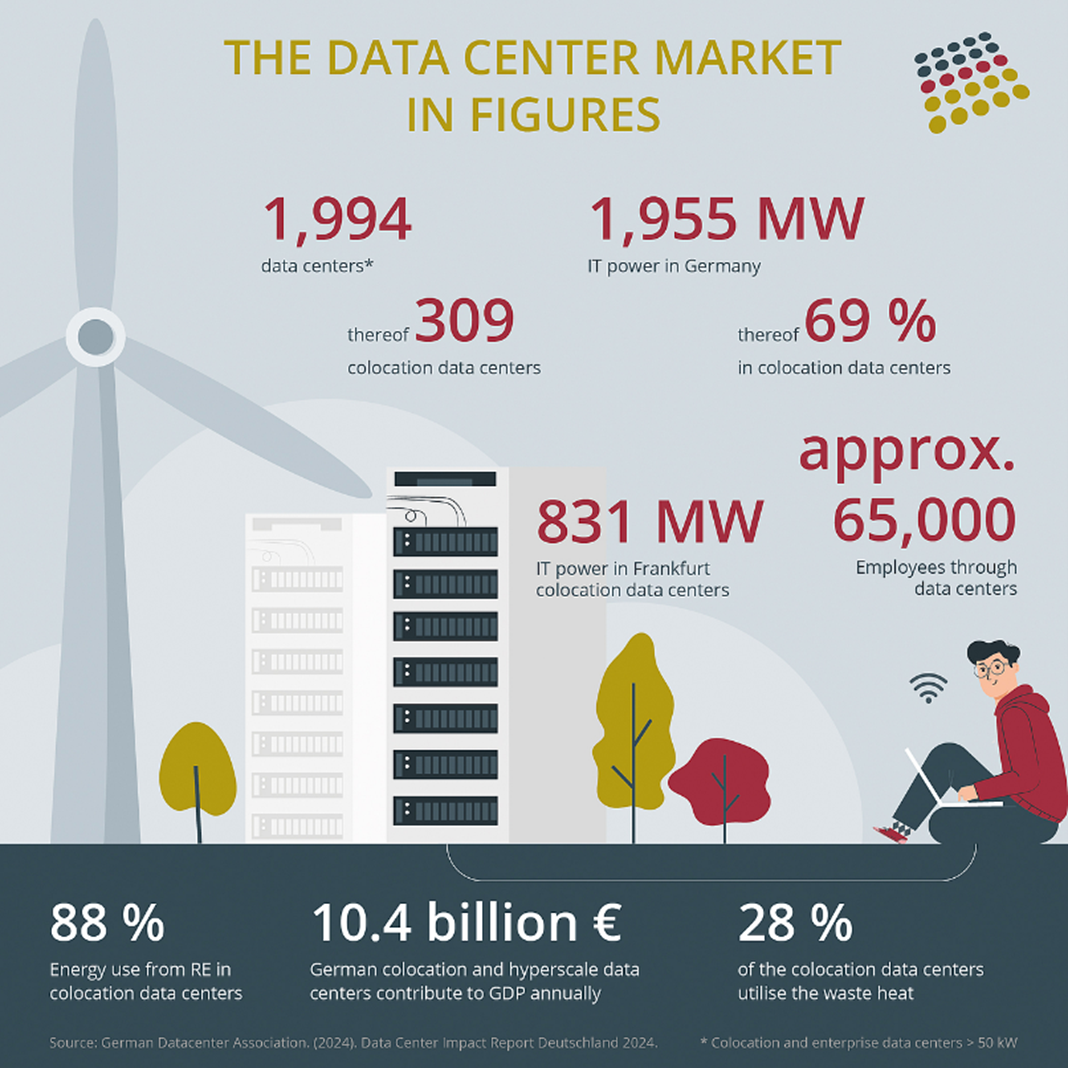

The data center market in Germany is experiencing substantial growth and digital transformation, driven by cloud adoption, enterprise modernization, and the increasing demand for edge computing. It is estimated to reach 2.33 thousand MW by 2030, up from 1.69 thousand MW in 2025. Colocation revenue is also expected to increase from USD 3,055.7 million in 2025 to USD 4,486.7 million by 2030. This growth is driven by:

- Cloud Adoption: Approximately 83% of German companies utilize cloud services.

- Digital Transformation: Germany is positioning itself as a leader in Industry 4.0, with significant investment in automation technologies.

- Financial Sector Innovation: A growing number of Germans are using contactless payments, which is boosting the digitalization of banking services.

Key trends and developments

- Sustainability: Germany is a leader in sustainable data centers, driven by ambitious climate goals and rising demand. ESG is central to new projects, starting with site selection. Colocation centers often use Power Purchase Agreements (PPAs) for renewable energy, reducing costs, and supporting green projects. The German Energy Efficiency Act (EnEfG) mandates data centers to source 50% of their power from unsubsidized renewables by 2024 and 100% by 2027. Innovation in cooling, heat recovery, and green materials is crucial. The “Pact for Climate-Neutral Data Centers” aims for climate neutrality by 2030, targeting a PUE of 1.3 (cool climates) or 1.4 (warmer). Some data centers are even LEED certified, with PUE < 1.2.

- 5G and M-commerce: Germany is a key player in 5G adoption in Europe, with almost 50% adoption rates. The German government launched a 5G Initiative to become a lead market for 5G applications. By 2030, Germany will account for around a quarter of cellular IoT connections in Europe. However, like other European nations, Germany faces challenges in keeping pace with 5G adoption compared to other regions.

- Market Dominance: In Germany’s data center market, massive data centers dominate, holding approximately 43% of the market share in 2024. Large data centers are experiencing the most rapid growth, projected to expand at approximately 9% CAGR from 2024 to 2029, driven by smart city developments and digitization initiatives.

- Location: Location will continue to be a critical factor. Frankfurt remains Germany’s data center hub, hosting 78% of massive facilities due to its robust infrastructure and proximity to DE-CIX, one of the world’s largest Internet exchange points. However, secondary cities like Berlin and Munich are emerging as attractive alternatives due to lower land costs and access to renewable energy sources like wind power from Brandenburg. Leading operators like Digital Realty, Global Switch, Equinix, NTT Ltd, CyrusOne, and Vantage Data Centers have established significant data center facilities across these locations.

The role of circular IT solutions

As German data centers work towards ambitious sustainability targets – such as achieving climate neutrality by 2030 – integrating circular IT strategies will be essential for developing a resilient and environmentally responsible industry. The adoption of these solutions not only enhances operational efficiency but also positions data centers as leaders in sustainable practices within the broader tech landscape.

The Circular Economy for the Data Centre Industry (CEDaCI) initiative highlights the necessity of transforming data center e-waste into valuable resources, advocating for a shift from traditional linear consumption models to more sustainable circular practices. By implementing strategies such as IT asset disposition (ITAD) and comprehensive data center decommissioning processes, facilities can effectively extend the lifespan of existing hardware, significantly reduce e-waste, and minimize the demand for new resources. This enables data centers to recover valuable materials from retired equipment, thus contributing to resource conservation. For instance, metals like copper and aluminum can be recycled and reused in new manufacturing processes, reducing the environmental impact associated with mining and production.

Refurbishing servers and networking equipment not only lowers capital expenditure but also aligns with the increasing emphasis on Environmental, Social, and Governance (ESG) principles. This is particularly relevant as German companies face mounting pressure to demonstrate their commitment to sustainability. Circular IT solutions enable data centers to have fit-for-purpose and top-performing IT infrastructures without using more of our precious, finite natural resources.

This also contributes to energy efficiency by optimizing hardware utilization and reducing the energy footprint associated with manufacturing new equipment. By maximizing the use of circular hardware, data centers can lower their overall energy consumption while still meeting performance and scaling demands. This is crucial as operators strive to achieve lower Power Usage Effectiveness (PUE) ratios and comply with regulations set forth by the German Energy Efficiency Act (EnEfG).

Conclusion

Germany’s data center market is on a trajectory of rapid expansion, driven by digital transformation, 5G adoption, and increasing demand for cloud services. With Frankfurt leading the charge and secondary hubs emerging, the sector is becoming a crucial pillar of Europe’s digital infrastructure. However, alongside this growth comes a responsibility: meeting ambitious sustainability goals while maintaining operational efficiency.

The shift toward greener data centers is already well underway. Regulations like the German Energy Efficiency Act and initiatives such as the “Pact for Climate-Neutral Data Centers” are paving the way for a more responsible industry. By embracing circular economy principles, Germany’s data centers can extend hardware lifecycles, reduce e-waste, and cut capital expenditures – all while staying ahead of regulatory pressures and ESG commitments.

The future of Germany’s data center landscape isn’t just about scaling up – it’s about doing so intelligently and sustainably. Businesses that invest in energy-efficient technologies and circular IT solutions today will be the ones leading the industry tomorrow. The question is no longer if sustainability should be a priority but rather how quickly companies can adapt to ensure long-term resilience and success. With our close to 20 years of experience in the circular IT world, we are always here to help you, so feel free to get in touch with our team!

Born and raised in southern Germany, Thomas Amberg is a European at heart. He combines an international mindset with his practical and dynamic approach to life. Studying and living abroad in the Netherlands and Denmark taught him to be adaptable and culturally aware. Now responsible for the development of DACH markets, he is also a passionate handball player.

Please note: The opinions expressed in Industry Insights published by dotmagazine are the author’s or interview partner’s own and do not necessarily reflect the view of the publisher, eco – Association of the Internet Industry.